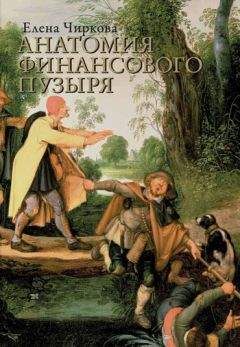

Елена Чиркова - Анатомия финансового пузыря

Помощь проекту

Анатомия финансового пузыря читать книгу онлайн

61. Chancellor, Edward (2000), Devil Take the Hindmost: a History of Financial Speculation. – N.-Y.: Plume.

62. Costain, Thomas (1955), The Mississippi Bubble. – N.-Y.: Random House.

63. Cowles, Virginia (1960), The Great Swindle; the Story of the South Sea Bubble. – N.-Y.: Harper.

64. D’Avolio, Gene (2002), The Market for Borrowing Stock // Journal of Financial Economics. November-December, 2002. Vol. 66. No. 2–3.

65. Darwiche, Fida (1986), Gulf Stock Exchange Crash the Rise and Fall of the Souq Al-Manakh. – London: Routledge.

66. Dawson, Frank (1990), First Latin American Debt Crisis. The City of London and the 1822 – 1825 Loan Bubble. – Princeton: Princeton University Press.

67. De Long, Brandford, and Shleifer, Andrei (1991), The Stock Market Bubble of 1929: Evidence from Closed-end Mutual Funds // Journal of Economic History. September 1991. Vol. 51. No. 3.

68. Devenow, Andrea, and Welch, Ivo (1996), Rational Herding in Financial Economics // European Economic Review. April 1996. Vol. 40. No. 3–5 .

69. Donaldson, Glen, and Kamstra, Mark (1996), A New Dividend Forecasting Procedure That Rejects Bubbles in Asset Prices: The Case of 1929’s Stock Crash // Review of Financial Studies. Summer 1996. Vol. 9. No. 2.

70. Dreman, David (1998), Contrarian Investment Strategies in the Next Generation. – N.-Y.: Simon & Schuster.

71. Dreman, David (1977), Psychology and the Stock Market. – N. Y.: Amacom.

72. Edelstein, Robert, and Jean-Michel, Paul (2002), Japanese Land Prices: Explaining the Boom-Bust Cycle in Mera Koichi and Bertrand Renaud, ed. Asia’s Financial Crisis and the Role of Real Estate. – Armonk, N. Y.: M.E. Sharp.

73. Faber, Mark (2008), Tomorrow’s Gold. Asia’s Age of Discovery. – Hong Kong: CLSA Books, 2008. (Первое издание: Faber, Mark (2002), Tomorrow’s Gold. Asia’s Age of Discovery. – Hong Kong: CLSA Books.)

74. Fama, Eugene (1998), Market Efficiency, Long-Term Returns, and Behavioral Finance // Journal of Financial Economics. September 1998. Vol. 49. No. 3.

75. Faure, Edgar (1977), The Banqueroute de Law. – Paris: Gallimard.

76. Festinger, Leon (1957), Theory of Cognitive Dissonance. – Stanford, CA: Stanford University Press.

77. Flandreau, Marc, and Flores, Juan (2007), Bonds and Brands: Intermediaries and Reputation in Sovereign Debt Markets 1820–1830 // Working Paper. July 2007.

78. Fleckenstein, William, and Sheehan, Fred (2008), Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. – N.-Y.: McGraw-Hill.

79. Flood, Robert, and Garber, Peter (1980), Market Fundamentals vs. Price Bubbles: The First Tests // Journal of Political Economy. August 1980. Vol. 88. No. 4.

80. Fodor, Giorgio (2002), The Boom that Never Was? Latin American Loans in London 1822–1825 // Working Paper University of Trento. 2002.

81. French, Doug (2006), The Dutch Monetary Environment During Tulipmania // The Quarterly Journal of Austrian Economics. Spring 2006.Vol. 9. No. 1.

82. Fridson, Martin (1998), It Was a Very Good Year. Extraordinary Moments in Stock Market History. – N.-Y.: John Wiley and Sons.

83. Fuller, Joseph, and Jensen, Michael (2002), Just Say No To Wall Street // Journal of Applied Corporate Finance. Winter 2002. Vol. 14. No. 4.

84. Galbraith, Kenneth (1993), A Short History of Financial Euphoria. – N.-Y.: Whittle Books.

85. Galbraith, Kenneth (1975), The Great Crash 1929. – London: Penguin Books, 1975. (Первое издание: Galbraith, Kenneth (1954), The Great Crash 1929. London: Penguin Books.)

86. Garber, Peter (1990), Famous First Bubbles // Journal of Economic Perspectives. Spring 1990. Vol. 4. No. 2.

87. Garber, Peter (1989), Tulipmania // Journal of Political Economy. June 1989. Vol. 97. No. 3.

88. Garber, Peter (2001), Famous First Bubbles. – Cambridge, Massachusetts: The MIT Press.

89. Gigerenzer, Gerd (2007), Gut Feelings: The Intelligence of the Unconscious. – N.-Y.: Viking.

90. Gigerenzer, Gerd (1991), How to Make Cognitive Illusion Disappear: Beyond ‘Heuristics and Biases // European Review of Social Psychology. 1991. Vol. 2.

91. Granovetter, Mark (1978), Threshold Models of Collective Behavior // American Journal of Sociology. May 1978. Vol. 83. No. 6.

92. Greenspan, Alan (2008), The Age of Turbulence. – London: Penguin Books.

93. Grinblatt, Mark, Titman, Sheridan, and Russ, Wermers (1995), Momentum Investment Strategies, Portfolio Performance, and Herding: A Study of Mutual Fund Behavior // American Economic Review. December 1995. Vol. 75. No. 5.

94. Grossman, Sanford, and Stiglitz, Joseph (1976), Information and Competitive Price Systems // American Economic Review. May 1976. Vol. 66. No. 2.

95. Harris, Ron (1994), The Bubble Act: Its Passage and its Effects on Business // Journal of Economic History. September 1994. Vol. 54. No. 3.

96. Hey, John, and Morone, Andrea (2004), Do Markets Drive Out Lemmings – Or Vise Versa? // Economica. November 2004. Vol. 71.

97. Hong, Harrison, Kubik, Jeffrey, and Solomon, Amit (2000), Security Analysts’ Career Concerns and Herding of Earnings Forecasts // RAND Journal of Economics. Spring 2000. Vol. 31. No. 1.

98. Irving, Janis (1982), Groupthink: Psychological Studies of Policy Decisions and Fiascoes. – Boston: Houghton Mifflin.

99. Jarvis, Christofer (1999), The Rise and Fall of the Pyramid Schemes in Albania // International Monetary Fund Working Paper. July 1, 1999. No. 98–99.

100. Jensen, Michael (2001), How Stock Options Reward Managers for Destroying Value // Harvard NOM Research Paper. April 2001. No. 04–27.

101. Lynch, Peter, and Rothchild, John (1993), Beating the Street. – N.-Y.: Simon & Schuster.

102. Katona, George (1975), Psychological Economics. – N.-Y.: Elsevier.

103. Kindleberger, Charles (1989), Manias, Panics, and Crashes: A History of Financial Crises. – N.-Y.: Basic Books. (Первое издание: Kindleberger, Charles (1978), Manias, Panics, and Crashes: A History of Financial Crises. – N.-Y.: Basic Books.)

104. King, Joseph (1910), History of the San Francisco Stock and Exchange Board. – San Francisco: The Stanley Taylor Company.

105. Klein, April (1990), A Direct Test of the Cognitive Bias Theory of Share Price Reversals // Journal of Accounting and Economics. July 1990. Vol. 13. No. 2.

106. Klein, Daniel, and Majewski, John (1994), Plank Road Fever in Antebellum America: New York State Origins // New York History. January 1994. Vol. 75. No. 1.

107. Kuran, Timur, and Sunstein, Cass (1999), Availability Cascades and Risk Regulation // Stanford Law Review. April 1999. Vol. 51. No. 4.

108. Kuran, Timur (1989), Sparks and Prairie Fires: A Theory of Unanticipated Political Revolution // Public Choice. April 1989. Vol. 61. No. 1.

109. Lamont, Owen, and Thaler, Richard (2003), Can the Market Add and Substract? Misspricing in Stock Market Carve-Outs // Journal of Political Economy. April 2003. Vol. 111. No. 2.

110. Larrick, Richard, and Soll, Jack (2003), Intuitions about Combining Opinions: Misappreciation of the Averaging Principle // INSEAD Working Paper. 2003.

111. Lee, In Ho (1998), Market Crashes and Informational Avalanches // The Review of Economic Studies. October 1998. Vol. 65. No. 4.

112. Leeson, Nick (1996), Rouge Trader. – London: Little, Brown and Company.

113. Leibenstein, Harvey (1950), Bandwagon, Snob and Veblen Effects in the Theory of Consumer Demand // Quarterly Journal of Economics. May 1950. Vol. 64. No. 2.

114. Lemiux, Pierre (2003–2004). Following the Herd. Regulation. Winter 2003–2004. Vol. 26. No. 4.

115. Levy, Eugene (2002), The Mind of Wall Street. – N.-Y.: Public Affaires.

116. Lewin, Henry (1968), Railway Mania and Its Aftermath, 1845–1852. – Newton Abbot: Davis and Charles. (Первое издание: Lewin, Henry (1936), Railway Mania and Its Aftermath, 1845–1852. – London.)

117. Lowenstein, Roger (2004), Origins of the Crash. – N.-Y.: The Penguin Press.

118. Macleod, Christine (1989), The 1690s Patents Boom – Invention or Stock Jobbing // Economic History Review. November 1989. Vol. 39. No. 4.

119. Mahar, Maggy (2004), Bull! A History of the Boom and Bust. – N.-Y.: Harper Collins Publishers.

120. Marсh, James (1991), Exploration and Exploitation in Organizational Learning // Organizational Science. February 1991. Vol. 2. No. 1.

121. McGrattan, Ellen, and Prescott, Edward (2000), Is the Stock Market Overvalued // Federal Reserve Bank of Minneapolis Quarterly Review. Fall 2000. Vol. 24. No. 4.

122. McGrattan, Ellen, and Prescott, Edward (2003), The 1929 Stock Market: Irving Fisher Was Right // Federal Reserve Bank of Minneapolis Research Department Staff Report 294. December 2003.

123. Mera, Koichi (2000a), The Linkage of the Economy with Land Price Fluctuations. The Case of Japan in the 1990s // Mera, Koichi, and Bertrand, Renaud, ed. Asia’s Financial Crisis and the Role of Real Estate. – Armonk, N.-Y.: M.E. Sharp.

124. Mera, Koichi (2000b), Land Price Ascent and Government Response in Japan // Mera, Koichi and Bertrand, Renaud, ed. Asia’s Financial Crisis and the Role of Real Estate. – Armonk, N.-Y.: M.E. Sharp.

125. Miller, Edward (1977), Risk, Uncertainty and Divergence of Opinion // Journal of Finance. September 1977. Vol. XXXII. No. 4.

126. Minsky, Hyman (1992), Financial Instability Hypothesis // The Jerome Levy Economics Institute of Bard College, Working Paper No. 74, May 1992.

127. Mitchell, Mark, Pulvino, Todd, and Stafford, Erik (2002), Limited Arbitrage in Equity Markets // Journal of Finance. April 2002. Vol. 57. No. 2.

128. Napier, Russell (2007), Anatomy of the Bear. – Petersfield, Hampshire, UK: Harriman House. (Первое издание: Napier, Russell (2005), Anatomy of the Bear. – Petersfield, Hampshire, UK: Harriman House).

129. Neal, Larry (1990), The Rise of Financial Capitalism: International Capital Markets in the Age of Reason. – Cambridge, UK: Cambridge University Press.

130. Nocera, Joseph (2004), A Piece of The Action. How the Middle Class Joined the Money Class. – N.-Y.: Simon and Schuster.

131. Ofek, Eli, and Richardson, Mathew (2003), Dotcom Mania: The Rise and Fall of Internet Stock Prices // Journal of Finance. June 2003. Vol. 58. No. 3.

132. Porter, David, and Smith, Vernon (2003), Stock Market Bubbles in the Laboratory // Journal of Behavioral Economics. 2003. Vol. 4. No. 1.

133. Pratt, Theodore (1951), The Big Bubble; a Novel of the Florida Boom. – N.-Y.: Duell, Sloan and Pearce.

134. Rappoport, Peter, and White, Eugene (1994), Was the Crash of 1929 Expected? American Economic Review. March 1994. Vol. 84. No. 1.

135. Rappoport, Peter, and White, Eugene (1993), Was There a Bubble in the 1929 Stock Market? // Journal of Economic History. September 1993. Vol. 53. No. 3.

136. Ritter, Jay (1991), The Long Run Performance of Initial Public Offerings // Journal of Finance. March 1991. Vol. 46. No. 1.

137. Roberts, Kenneth (1926), Sun Hunting. – Indianapolis: The Bobbs-Merrill Company Publishers.

138. Rothchild, John (1996), When the Shoeshine Boys Talk Stocks // Fortune. April 15, 1996.

139. Rothschild, Michael, and Stiglitz, Josef (1976), Equilibrium in Competitive Insurance Markets: An Essay on the Economics of Imperfect Information // Quarterly Journal of Economics. November 1976. Vol. 90. No. 4.

140. Rowe, Donald (2001), Will Mr Greenspan Prevent the Recession? // The Wall Street Digest. January 2001.

141. Rubin, Robert, and Wesberg, Jacob (2004), In an Uncertain World. Though Choices from Wall Street to Washington. – N.-Y.: Random House.

142. Saint-Simon, Louis de Rouvroy, duc de. Memoirs of Louis XIV and His Court and of the Regency: http://www.gutenberg.org/etext/3875.

143. Sakolski, Aaron Morton (1932), The Great American Land Bubble; the Amazing Story of Land-Grabbing, Speculations, and Booms from Colonial Days to the Present Time. – N.-Y.: Harper.

144. Scharfstein, David, and Stein, Jeremy (1990), Herd Behavior and Investment. American Economic Review. June 1990. Vol. 80. No. 3.

145. Schelling, Thomas (1972), A Process of Residential Segregation: Neighborhood Tipping, in Racial Discrimination in Economic Life: edited by Pascal A. – Lexington, MA: Lexington Books.

146. Schelling, Thomas (1971), Dynamic Models of Segregation // Journal of Mathematical Sociology. July 1971. Vol. 1. No. 2.

147. Shefrin, Hersh (2000), Beyond Greed and Fear: Understanding Behavioral Finance and the Psychology of Investing. – Boston: Harvard Business School Press.

148. Shiller, Robert, Kon-Ya, Fumilo, and Tsutsui, Yoshiro (1996), Why Did the Nikkei Crash? Expending the Scope of Expectations Data Collection // The Review of Economics and Statistics. February 1996. Vol. 78. No. 1.

149. Shiller, Robert (1981), Do Stock Prices Move Too Much to be Sustified by Subsequent Changes in Dividends? // American Economic Review. June 1981.Vol. 71. No. 3.

150. Shiller, Robert (2005), Irrational Exuberance. – N.-Y.: Brodway Books. (Первое издание: Shiller, Robert (2000), Irrational Exuberance. – N.-Y.: Brodway Books.)

151. Shleifer Andrei, and Vyshny, Robert (1997), Limits of Arbitrage // Journal of Finance. March 1997. Vol. 52. No. 1.

152. Simon, Herbert (1967), Rationality and Administrative Decision Making in Models of Man Social and Rational. – N.-Y.: Wiley.

153. Simon, Нerbert (1976), Administrative Behavior. – N.-Y.: Free Press.